Banking with Bluevine

that exceeds expectations.

A next-generation banking platform built to support your current needs and future growth—offering low fees, hassle-free transfers, and access to essential capital.

Please note: Bluevine is a fintech provider, not a licensed bank.

All funds are FDIC-insured via Coastal Community Bank, Member FDIC, and our partner institutions.

Join Bluevine.com, the top-ranked small business banking network in the United States

-

10 years serving entrepreneurs

-

Over 750,000 businesses supported²

-

$1.4+

billion in deposits -

$16+billion accredited to businesses²

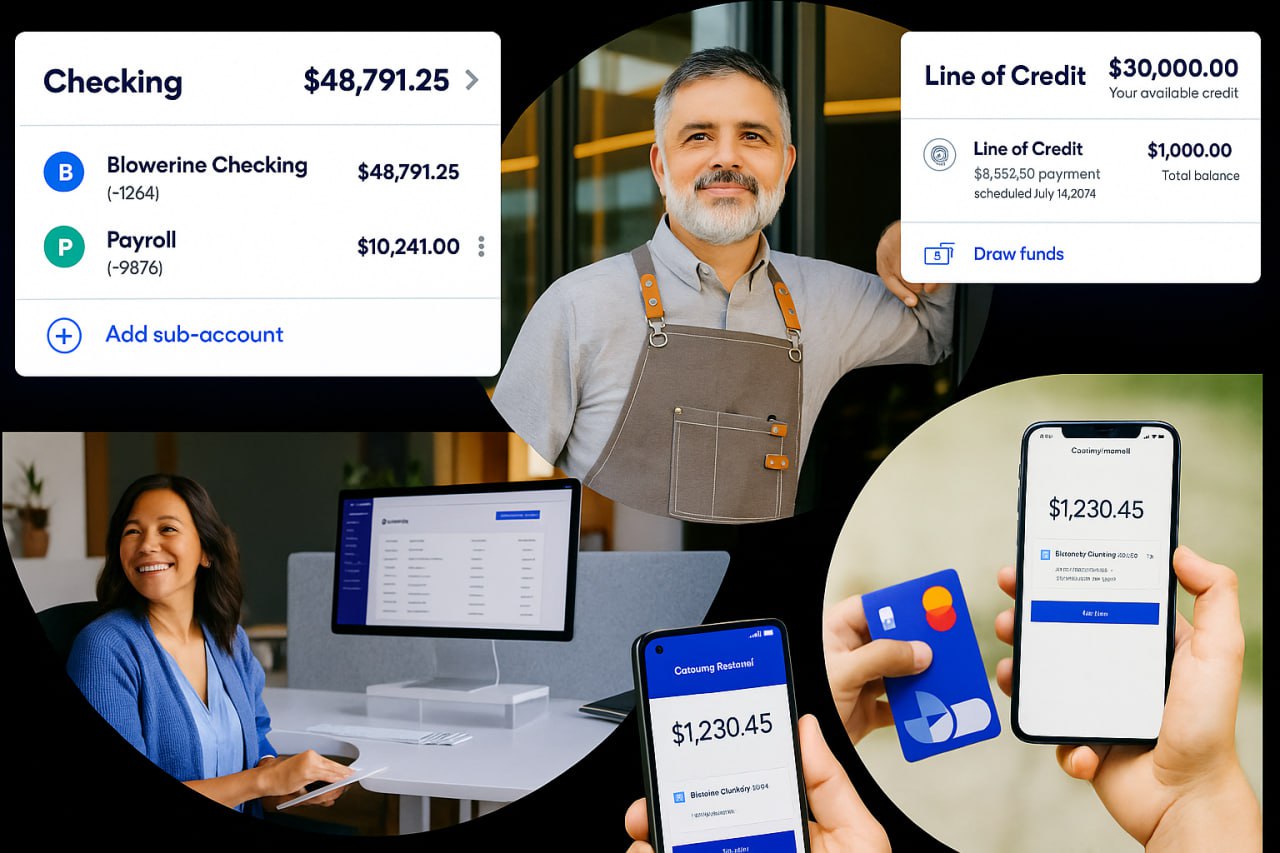

Everything in one place

to simplify your financial operations

Get full access to checking, credit, billing, and financing from a single, unified interface

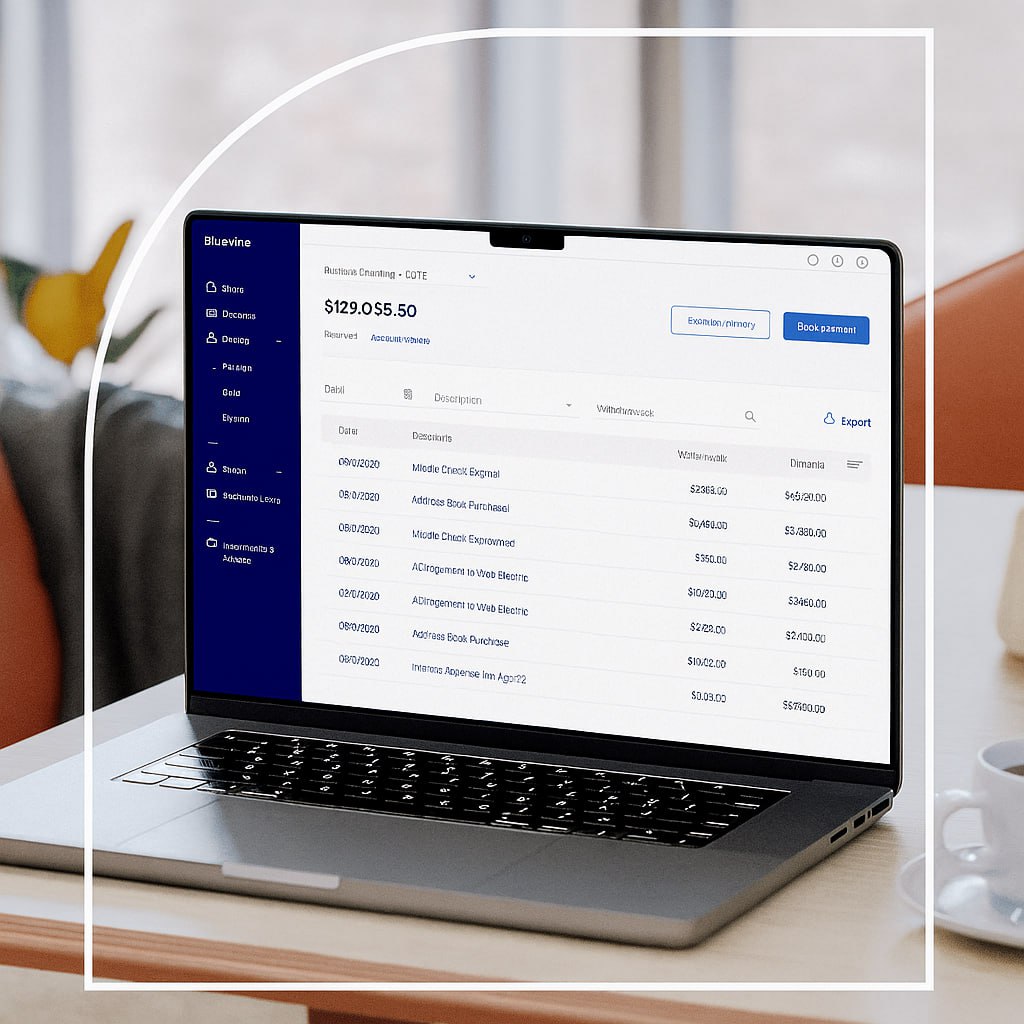

Smarter Business Checking that gives your capital more value

Gain access to intelligent fund management tools, automated bill pay, and responsive support—with no need to visit a branch

-

Up to 1.5% APY for qualifying users³ on Standard or higher-tier plans

-

No maintenance fees, unlimited transactions⁴, and free standard ACH

-

FDIC coverage up to $3 million⁵

- Choose a plan tailored to your business.

Unlock even greater rewards with Plus or Premier—earn up to 3.7% APY and save on payment fees.⁶

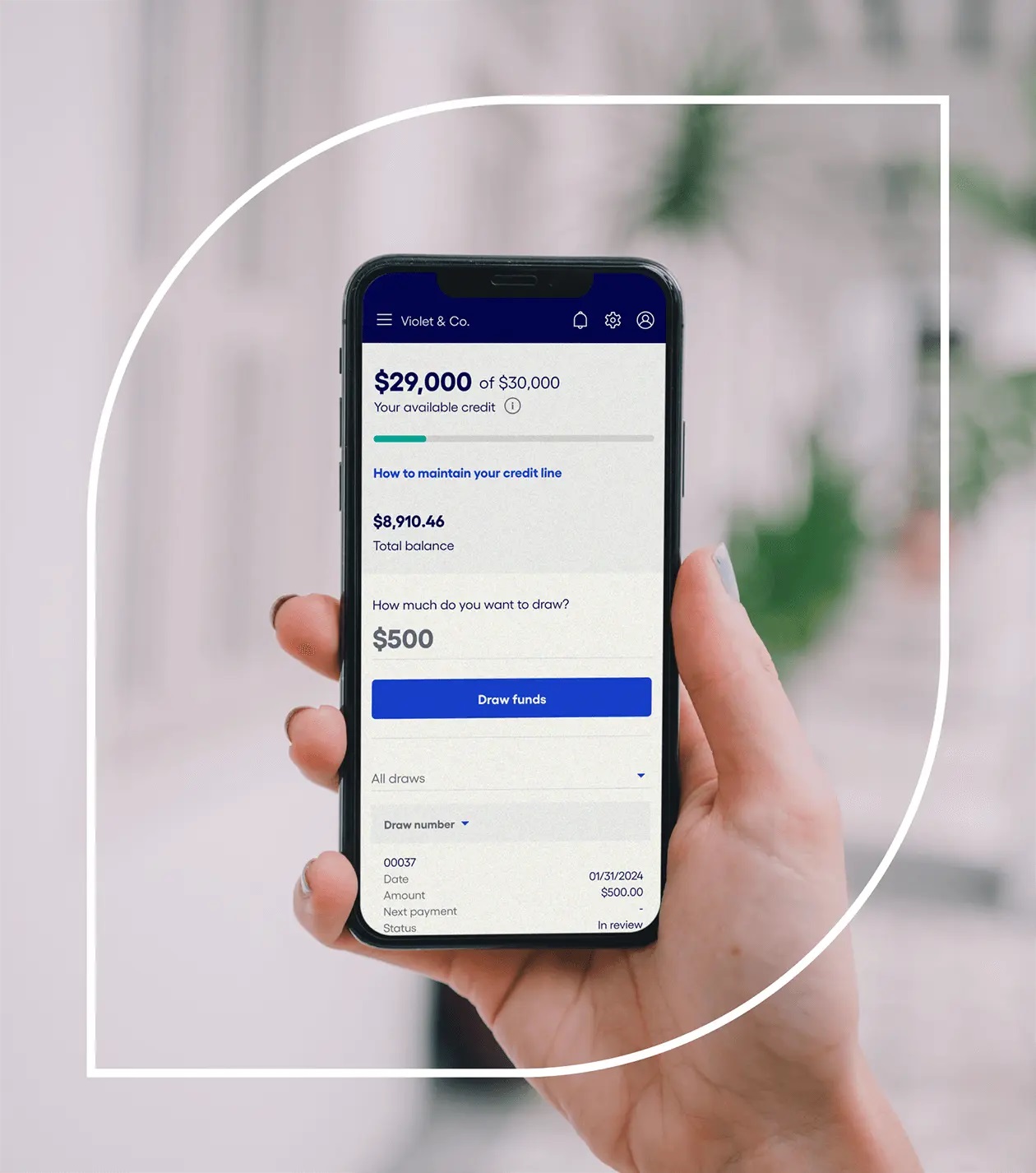

Business Capital to accelerate your vision

Apply online for a credit line of up to $250,000 or request a business loan of up to $500,000—all through a single streamlined process.⁷

Competitive rates and customizable repayment options

Apply without impacting your credit rating⁸

Decisions available in as little as 24 hours

Invoicing & Payment Tools that help get paid—fast

Easily create and manage invoices and payment links directly within your Bluevine dashboard

- Issue unlimited professional invoices at no extra charge

-

Secure, Stripe-powered payment links⁹

- Transparent and low-cost card processing

Business Credit Card rewards with no yearly fees

Link your card to accounting software, build strong credit, and earn back on business purchases

-

Unlimited 1.5% cashback on qualified transactions¹⁰

-

Robust protection against fraud

-

Exclusive Mastercard benefits and perks¹¹

Business credit card with unlimited cash back and

no annual fee.

Sync to your financial tools and build business

credit with consistent, on-time repayments.

- Unlimited 1.5% cash back on all business purchases 10

- Advanced security and fraud protection

- Exclusive Mastercard perks and benefits 11

Secure Digital Banking

-

Two-factor login

to keep your account protected

-

Data encryption

for personal and business safety

-

Real-time alerts

for suspicious activity or transactions¹²

What our clients are saying

And why you’ll appreciate Bluevine too

Industry Recognition

- Best Checking Account for SMBs CNBC 2025

-

Leading SMB Banking Solution

Tearsheet 2023 - Power Partner Winner Inc. Magazine 2023

- Top Free Business Account Nerdwallet 2025

- Top Startup Employer Forbes 2023

Bluevine login!

Want to learn more?

Explore our Resources and Guides.